In anticipation of the upcoming launch of the VNX Exchange platform we are pleased to start the Product Updates series to help you better understand how the platform works and guide the users through its functionality.

In this first issue we will start from the basics and will tell you about the VNX solution and the target architecture of the platform. Further on we will cover one by one main functional blocks of the platform to help you easily navigate and use all the advantages we offer in order to help you achieve your goals.

VNX Exchange is a Luxembourg-based asset-backed token issuance platform also aiming to create a secondary trading marketplace.

We open alternative investment opportunities (such as investments into startup portfolios, selected startups and/or non-public companies, pre-IPO companies, etc.) for institutional and regular investors alongside top-tier lead investors.

VNX created a unique solution combining both technological and legal know-hows represented by a new class of liquid assets – Digital Claim Receipts (DCR). It is a digital asset backed by securitized income (proceeds) from the underlying assets. VNX issues tokens which are backed only by verified and carefully selected assets and managed by professional venture/investment funds who will be taking care of maximizing investors’ profits.

Via VNX solution the issuer will procure the distribution of the proceeds from the underlying assets to DCR holders during the whole life-cycle of the DCRs.

Secondary market trading at VNX Exchange (which is under development) will allow DCR holders to limit their exposure against the long-term performance of the assets and to support the liquidity of DCR tokens.

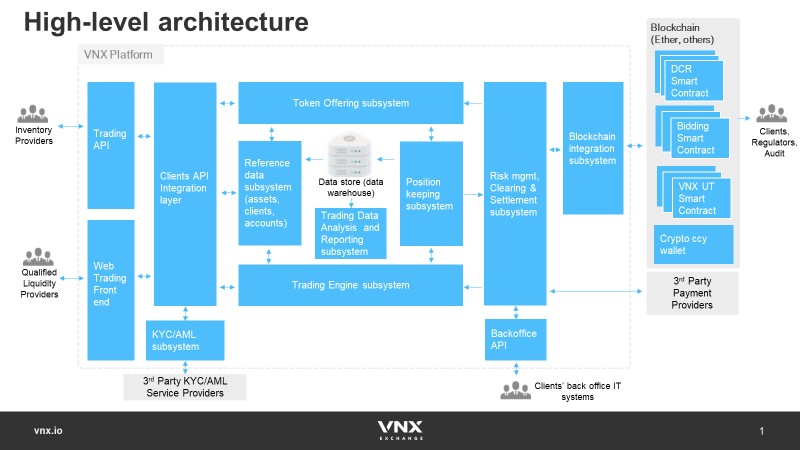

The main components of the VNX platform are depicted in the piсture below. The platform is being developed as a set of loosely coupled microservices with clearly defined APIs, interconnected by a real-time integration layer (integration bus). For performance-sensitive and highly available parts of the platform, such as trading engines, the microservices architecture allows both horizontal scalability of platform processing power to cope with raising trading loads by scaling the hardware only and at the same time ensures high availability of trading engines. The pluggable architecture of microservices allows for easy extension and changes of their functionality without rewriting the whole Platform from scratch.

Post trade infrastructure will also provide APIs for implementation of straight through processing (STP) of trade information by clients’ middle- and back-office IT systems. All business-critical information will be reliably stored in the platform’s own data store for audit purposes and as a “big data” type of data source for future value-added services.

The next Product Update will guide you through the process of registration on the VNX platform and KYC verification.

Stay tuned and join our social media below to be the first to get important news about the project’s development.

Go to VNX Platform

Stay informed.

Subscribe to our newsletter