Today we would like to guide you through the process of the registration at the VNX platform and tell you more about KYC checks built-in to the platform.

VNX is a regulatory compliant and is committed to the highest standards of prevention of money laundering and financing of terrorism.

What is a KYC/AML and why it’s important?

KYC (Know Your Customer) is a process of customer identity verification during the onboarding procedure. AML (Anti Money Laundering) means the actions aiming to prevent money laundering and terrorism financing and performed at later stages, for example during the process of funds deposits and/or transfers.

What documents and information are required for KYC?

VNX Platform deploys automated onboarding and compliance systems that allow to check and verify the authenticity of documents, personal data screening and other methods that help our compliance team to make a decision on acceptance of the customer depending on the risk category.

We handle your personal data only for compliance purposes and use it strictly in accordance with the Privacy Policy. Due to regulatory restrictions, we are not able to onboard customers from certain countries.

To make your process of KYC check quicker and more comfortable please read and prepare the following information and documents required by the system:

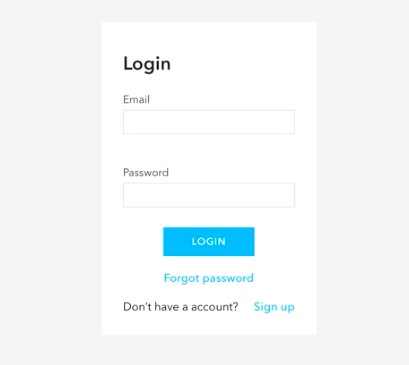

Step 1. Sign in

Create account or sign in to VNX platform at https://invest.vnx.lu.

You will be offered to create your login and password.

Please read and accept our Terms & Conditions and Privacy Policy, confirm that you are not a resident from restricted countries and that your age is 18+.

To finish sign in process you’ll need to verify and confirm your email.

Step 2. KYC check

After signing in to the VNX platform you will be requested to go through the KYC checks to access your account and start investing.

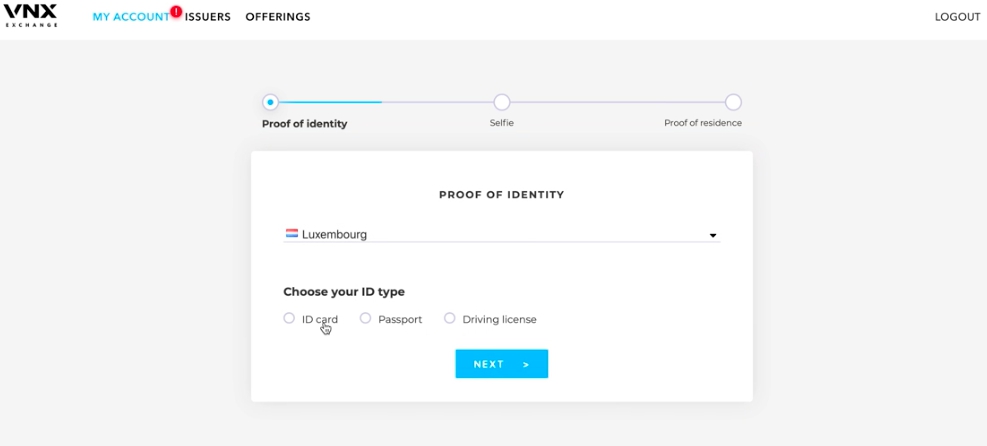

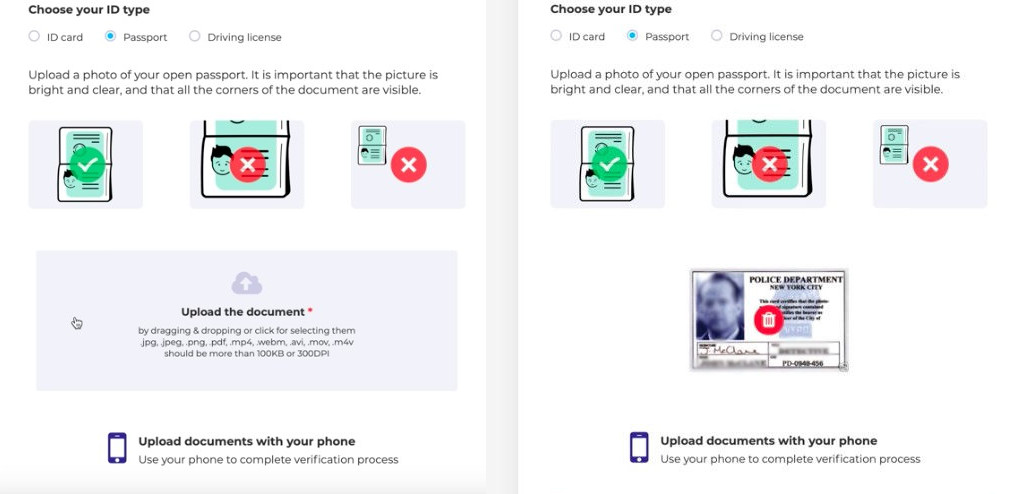

2.1 Proof of Identity

For the beginning choose the country of your residence and type of ID for verification.

Then upload a photo of your ID. The KYC system also supports documents issued in non-english languages. It is important that the picture is bright and clear, and that all the corners of the document are visible.

2.2 Pass liveness check

Liveness is an identity verification based on image-processing, face-mapping and motion detection mechanisms. Please switch on the camera on your device and follow the instructions on the screen.

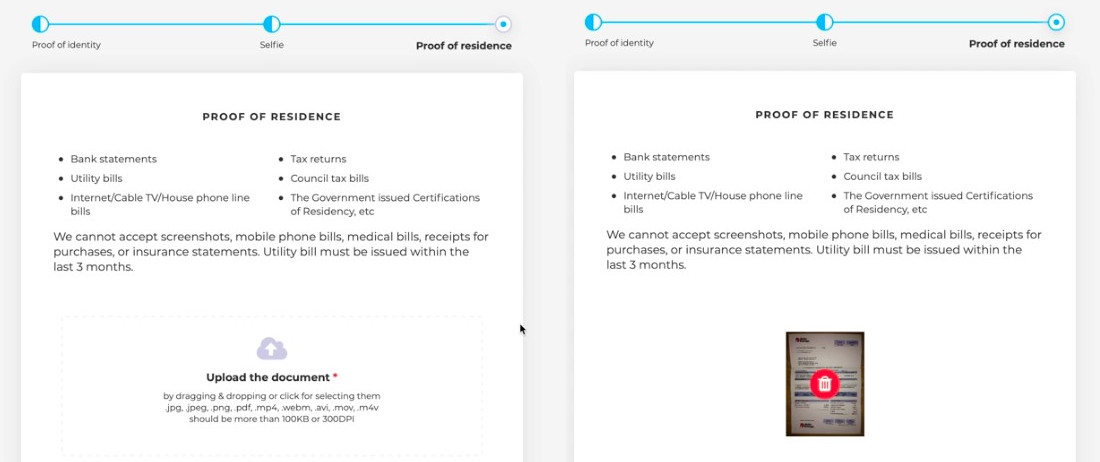

2.3 Upload proof of your residence

The system accepts utility bills, internet/cable TV/House phone line bills, bank statements, tax returns, council tax bills and the government issued Certificates of Residency and others.

Please note that the system does not accept screenshots, mobile phone bills, receipts for purchases or insurance statements. Utility bill must be issued within the last 3 months.

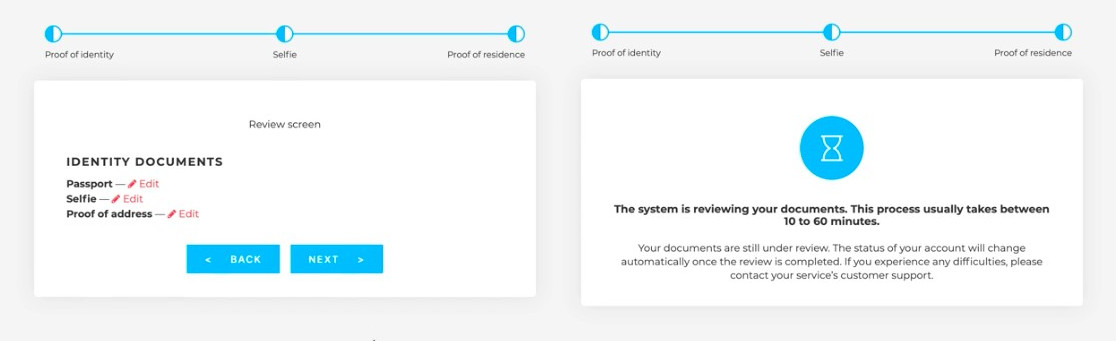

4. Review information and submit

The system check will take from 10 to 60 minutes (in some cases the check could take more time). The status of your account will change automatically once the review is completed.

We tried to make the onboarding process easy, comfortable and secure. If you have any questions or troubles with this process, you are always welcome to contact our support via chat at the platform.

After completion of the KYC procedures you will be able to access your account, deposit funds (please note that depending on the amounts additional documents might be requested, in particular, documents confirming the source of funds/wealth) and start using the VNX Platform services.

Start KYC on VNX Platform.

Stay informed.

Subscribe to our newsletter